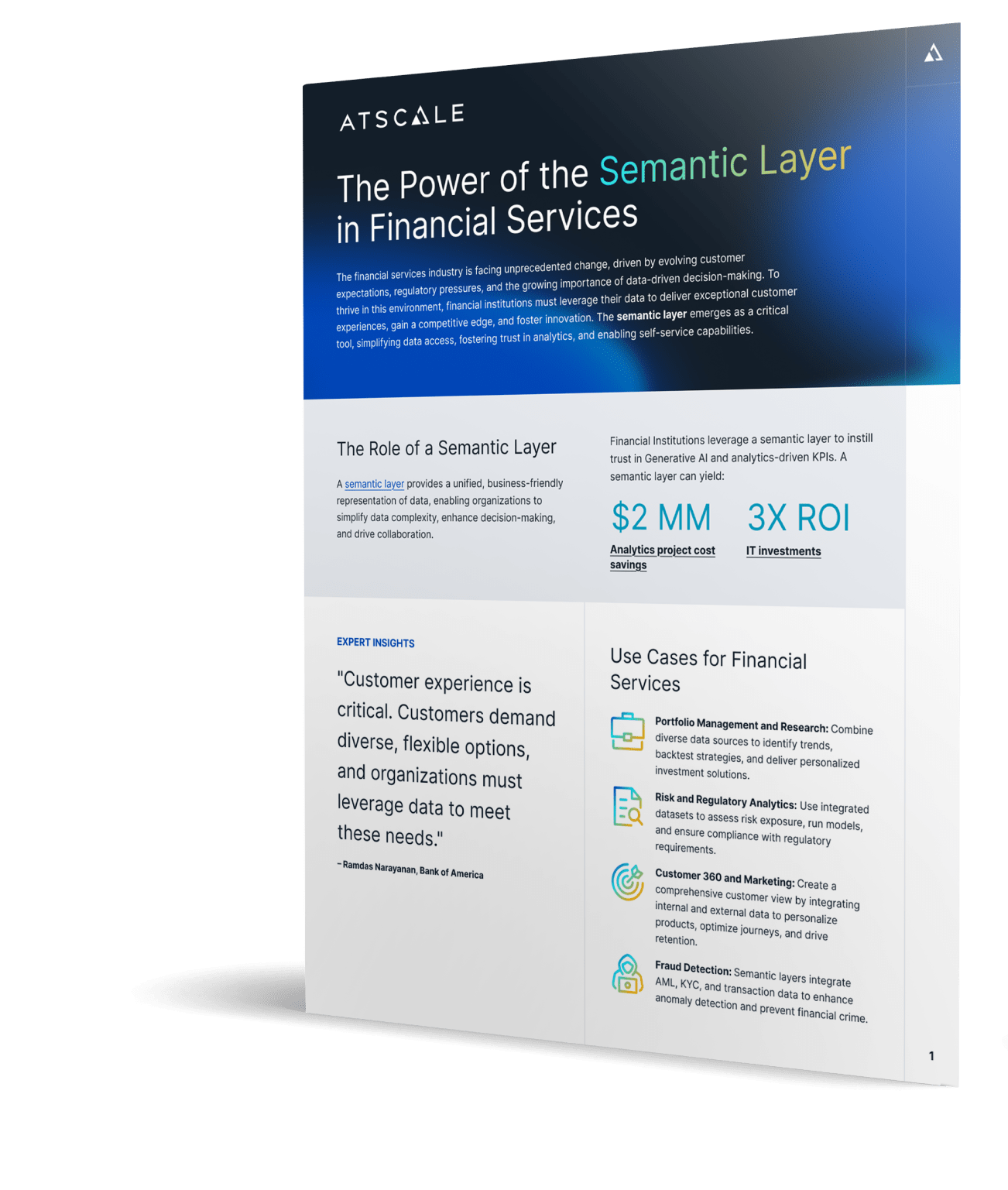

The Role of a Semantic Layer

A semantic layer provides a unified, business-friendly representation of data, enabling organizations to simplify data complexity, enhance decision-making, and drive collaboration. Some key benefits include:

-

- Simplified Data Access: Maps complex datasets into business terms like “portfolio,” “revenue,” or “customer.”

- Faster Time to Insight: Accelerates query performance and reduces data preparation time.

- Trusted Insights: Ensures data consistency and governance for regulatory compliance.

- Cost Optimization: Reduces cloud costs by eliminating redundant data processing and optimizing compute usage.

Financial Institutions leverage a semantic layer to instill trust in Generative AI and analytics-driven KPIs. A semantic layer can yield:

- $2+ million in analytics project cost savings

- 3x increase in ROI of IT investments

ROI of Semantic Layers in Financial Services

- Optimized Cloud Costs: Semantic layers reduce cloud analytics costs by over 3x by optimizing compute usage, improving query performance, eliminating redundant data copies, and streamlining data preparation.

- Optimized Human Capital Costs: Using a semantic layer reduces the effort for a typical 1,000-hour analytics project by nearly half. An average organization has 25 such projects annually, estimating savings of $2.3 million annually.

- Trusted Results through Data Governance: AtScale’s semantic layer delivers result consistency and improves text-to-SQL performance, achieving nearly 100% accuracy by providing analysts and LLMs with a common business language, by mapping diverse data into familiar terms like “product,” “customer,” and “revenue.”

- Improved Customer Outcomes: Accelerate time-to-insight by 4x, enabling proactive decision-making that enhances customer experiences.